User:Jaureese11/sandbox

Supreme Court Decision

[edit]

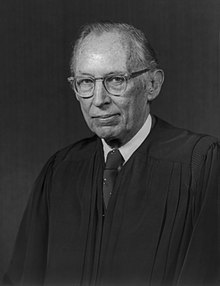

Bob Jones University v. Simon was decided May 15, 1974 in an 8-0 decision with majority opinion written by Lewis F. Powell, in which Justice Burger, Brennan, Stewart, White, Marshall, and Rehnquist joined. Justice Blackmun filed an opinion concurring in the result of the Court's decision. Justice Douglas, took no part in the decision of this case.[1] The Court held that the Anti-Injunction Act of the Internal Revenue Code, 26 U. S. C. § 7421(a), prohibited the University from obtaining judicial review by way of injunctive action. The Court further upheld that the Court of Appeals did not err in "holding that § 7421(a) deprived the District Court of jurisdiction to the issue of injunctive relief the petitioner sought."[2] Lastly, the Court admits to recognizing the "harsh regime" in which § 7421(a) has placed on §501 (c)(3) organizations threatened with loss of tax-exempt status and withdrawal of advanced assurance of deductibility of contributions. But, the Court stated that "this matter is for Congress, which is the appropriate body to weigh the relevant, policy-laden considerations, such as the harshness of the present law."[3][4]

Section 501(c)(3)

[edit]Within section I of the court's opinion the court sought to detail the provisions which outlined the requirements needed in order for an organization to be exempt from taxes and receive tax-deductibles.

Section 501(a) of the Internal Revenue Code of 1954(Code) exempts from federal income taxes organizations described in § 501(c)(3). The latter provision encompasses:

Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or for the prevention of cruelty to children or animals, no part of the net earnings of which inures to the benefit of any private shareholder or individual, no substantial part of the activities of which is carrying on propaganda, or otherwise attempting, to influence legislation, and which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of any candidate for public office.[5][6][7]

Furthermore,Section 501(c)(3) organizations are also exempt from federal social security (FICA) taxes by virtue of Code § 3121(b)(8)(B), 26 U.S.C. § 3121(b)(8)(B), and from federal unemployment (FUTA) taxes by virtue of § 3306(c)(8), 26 U.S.C. § 3306(c)(8). Donations to § 501(c)(3) organizations are tax deductible under § 170(c)(2).[8]

In addition, technical compliance with the language of §§ 501(c)(3) and 170(c)(2)was not sufficient, the organization must also obtain a ruling letter from the service declaring that it qualifies under § 501(c)(3). Receipt of such a ruling letter lead to inclusion of the Service's Cumulative List of Organizations described in § 170(c)(2) of the Internal Revenue Code of 1954. In essence, the Cumulative List is the Service's official roster of tax-exempt organizations. An organizations inclusion in the Cumulative List assured its potential donors that contributions to the organization would qualify as charitable deductions under § 170(c)(2)[9][10]

Revocation of a § 501(c)(3) ruling letter and removal from the Cumulative List subjects the affected organization to FICA and FUTA taxes and, assuming that the organization has taxable income and does not qualify as tax exempt under another subsection of § 501, to federal income taxes. Upon the assessment and attempted collection of income taxes , a provision allowed an organization to litigate the legality of the Service's action by petitioning the Tax Court to review a notice of deficiency. Or, following the collection of any federal tax and the denial of a refund by the Service, the organization could bring a refund suit in a federal district court or in the Court of Claims.[11]

Justicability

[edit]Within Section III of the opinion the Court sought to explicate the language of the Anti-Injunction Act, as well as, its applicability to this particular case. The court made it explicit that the language of The Anti-Injunction Act made it clear that "no suit for the purpose of restraining the assessment or collection of any tax shall be maintained in any court."[12]. Organizations seeking injunctive relief against the Service of the proposed action "conflict directly with a congressional prohibition of such pre-enforcement tax suits." [13]Cite error: A <ref> tag is missing the closing </ref> (see the help page). Furthermore, the courts have interpreted the principle language of the act to serve as "the protection of the Government's need to assess and collect taxes as expeditiously as possible with a minimum of pre-enforcement judicial interference."[14][15] Moreover, disputes between the language of the Anti-Injunction Act and the desire of § 501(c)(3) organizations to block the Service from withdrawing a ruling letter has been resolved against the organizations in a majority of cases.[16]

It was held that (1) operation of the Anti-Injunction Act could be avoided only if there was proof of both irreparable injury and certainty of success on the merits, a pre-enforcement injunction being permissible only if it was clear that under no circumstances could the government ultimately prevail; (2) the instant action was a suit "for the purpose of restraining the assessment or collection of any tax"[17] under the Anti-Injunction Act, since (a) the plaintiff's allegations indicated that a primary purpose of the suit was to prevent the assessment and collection of income taxes from the plaintiff, (b) even if the plaintiff would owe no federal income taxes because of possible deductions for depreciation of plant and equipment, the plaintiff would still be liable for federal social security and unemployment taxes, which taxes were also contemplated by the Anti-Injunction Act, and (c) in any event, the plaintiff sought to restrain the collection of taxes from its donors by forcing the Internal Revenue Service to continue to provide advance assurance that contributions to the plaintiff would be tax-deductible, thereby reducing the donors' tax liability, which aspect was also covered by the Anti-Injunction Act even though the plaintiff sought to lower the taxes of persons other than itself; (3) the Anti-Injunction Act was not rendered inapplicable on the ground that the Service's actions constituted an attempt to regulate the admissions policies of private universities rather than an effort to protect the government's tax revenues, since there was no showing that the Service's position did not represent a good-faith effort to enforce technical requirements of the tax laws; (4) application of the Anti- Injunction Act did not deny due process of law to the plaintiff because of any irreparable injury it would suffer pending resort to alternative procedures for review whereby the plaintiff could obtain Tax Court review of any assessment for income taxes or alternatively could institute a refund suit after payment of income, social security, or unemployment taxes, since such alternative procedures offered the plaintiff a full, even though delayed, opportunity to litigate the legality of the Service's actions; and (5) the Anti-Injunction Act barred the instant action since the plaintiff's contentions as to violations of its constitutional rights were sufficiently debatable so as to foreclose the necessary determination that under no circumstances could the government ultimately prevail.[18][19]

Concurring Opinion

[edit]

Justice Blackmun concuring on the result of the Court:

Justice Blackmun expressed the view that the purpose of the suit was to restrain "the assessment and collection" of a tax under the Anti-Injunction Act, since an injunction, if granted, would directly prevent the collection of income taxes from the plaintiff, and the action was barred since it had not been shown that under no circumstances could the government ultimately prevail.[20][21]

- ^ 416 U.S. 725, *94 S. Ct. 2038, **40 L. Ed. 2d 496, ***1974 U.S. LEXIS 9

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section IV (1974)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section IV (1974)

- ^ Bob Jones University v. United States 461 U.S. 574 (1982)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section I (1974)

- ^ IRS, . 6 Apr 2014. <http://www.irs.gov/Charities-&-Non-Profits/Charitable-Organizations/Exemption-Requirements-Section-501(c)(3)-Organizations>.

- ^ Bob Jones University v. United States 461 U.S. 574 (1982)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section I (1974)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section I (1974)

- ^ . N.p.. Web. 6 Apr 2014. <http://www.irs.gov/Charities-&-Non-Profits/Search-for-Charities>.

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section I (1974)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section III (1974)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section I (1974)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section III (1974)

- ^ Bob Jones University v. United States 461 U.S. 574 (1982)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section III (1974)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section III (1974)

- ^ Bob Jones University v. Simon , 416 U.S. 725, 94 S. Ct. 2038, 40 L. Ed. 2d 496, 1974 U.S. LEXIS 9

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section III (1974)

- ^ Bob Jones Univ. v. Simon, 416 U.S. 725, U.S. Supreme Court, section Concurring Opinion of Justice Harry Blackmun (1974)

- ^ Bob Jones University v. Simon , 416 U.S. 725, 94 S. Ct. 2038, 40 L. Ed. 2d 496, 1974 U.S. LEXIS 9