User:Noname5280/Reading Railroad Company v. Pennsylvania (1872)

Reading Railroad Company v. Pennsylvania

[edit]| Reading Railroad Company v. Pennsylvania | |

|---|---|

| |

| Decided March 7, 1872 | |

| Full case name | Reading Railroad Company v. Pennsylvania |

| Citations | 82 U.S. 232 (more) |

| Court membership | |

| |

| Case opinion | |

| Majority | Strong |

Reading Railroad Company v. Pennsylvania 82 U.S. 232 (1872)[1] was a U.S. Supreme Court decision that ruled that the state of Pennsylvania was violating the Constitution by imposing unjust taxes on interstate commerce.[2]

The case was brought by the Reading Railroad Company, which challenged Pennsylvania's Act of August 25, 1864, also referred to as Pennsylvania's Revenue Act of 1864[2][3]. The act was established to provide additional revenue for the Commonwealth of Pennsylvania after the American Civil War. It imposed systematic taxes on businesses, based on their gross receipts, for municipal purposes.[3][4]

The Reading Railroad Company argued that the tax burdened it's ability to operate within the state of Pennsylvania, and thus interfered with interstate commerce. The company also argued that railroad companies who operated across state lines were specifically discriminated as they were taxed higher than local businesses. [3]

Contextual Background

[edit]American Civil War

[edit]

Overview

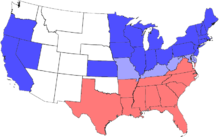

[edit]The American Civil War was fought between 1861 and 1865 as a result of the tensions between the northern (Union) states and the southern (Confederate) states. Historically, the North powered its economy through industrial means, emphasizing manufacturing. In contrast, the South powered its economy through agriculture, emphasizing the production of cotton and tobacco. They established systems of slavery to support large-scale farming. These economic differences largely stemmed from how each region used its environment, with the North benefiting from its access to natural resources and the South taking advantage of its fertile soil.[5] However, their differing practices caused social disagreements, particularly on the morality of enslavement.[6]

Upon the Presidential election of a unionist, Abraham Lincoln, the southern states feared that slavery would be abolished and tensions heightened. The southern states then formed the Confederate States of America to secede from the other states. While the southern states wanted to break away, the northern states aimed to preserve the union of the country, which ultimately lead to the outbreak of war. The war lasted for approximately four years until the Confederacy surrendered.[6]

Pennsylvania's Involvement

[edit]As a Union state, Pennsylvania was heavily involved in the manufacturing industry.

[In progress]

Financial Impact of the Civil War

[edit]Pennsylvania's Revenue Act of 1864

[edit]On August 25th, 1864, the Legislature of Pennsylvania passed the Pennsylvania Revenue Act of 1864 (not to be confused with the U.S. Revenue Act of 1864).[4] The act imposed a tax on all companies that transported freight within the state of Pennsylvania and was included in a plan to raise revenue after the Civil War. The companies affected by this tax included railroad, steamboat, canal, and slack water navigation companies. The companies would receive a toll fee that varied in price depending on the weight and product type. For every 2,000 pounds of freight carried by mines, quarries, and clay beds, companies would pay a 2 cent toll. For hewn timber, animal food, agricultural products, or products of the forest, companies would pay a 3 cent toll. For all other products and freight not listed, they would pay a 5 cent tax.[3]

The rules are as follows:

"Where the same freight shall be carried over and upon different but continuous lines, said freight shall be chargeable with tax as if it had been carried but upon one line, and the whole tax shall be paid by such one of said companies as the State treasurer may select and notify thereof. Corporations whose lines of improvements are used by others for the transportation of freight, and whose only earnings arise from tolls charged for such use, are authorized to add the tax hereby imposed to said tolls and collect the same therewith, but in no case shall tax be twice charged on the same freight carried on or over the same line of improvements: Provided, That every company now or hereafter incorporated by this Commonwealth, whose line extends into any other State, and every corporation, company, or individual of any other State, holding and enjoying any franchises, property, or privileges whatever in this State, by virtue of the laws thereof, shall make returns of freight and pay for the freight carried over, through, and upon that portion of their lines within this State, as if the whole of their respective lines were in this State."

The problem lay with the Reading Railroad Company and the Erie Railroad who explained that some railroads like the 'Lake Shore Road' (picture) only pass through small sections of Pennsylvania also known as 'The Triangle' (diagram pic). The triangle mainly connects New York, New Jersey, New England and the West and briefly enters Pennsylvania for a few miles due to the surrounding geography.

[In progress]

Reading Railroad Company's Argument

[edit]Opposition

[edit][In progress]

In the transportation industry, the Reading Railroad was a very important aspect. These railroads were used for bringing coal from one place to another. For example, the coal would travel on the Reading Railroad from small parts of Pennsylvania to big cities such as New York. At the time, the coal industry counted on the Reading Railroad for the transportation of goods. When Pennsylvania demanded tax on the Reading Railroad, it's problems arose. The Reading Railroad company argued that the tax imposed on their railroads was not fair and decreased the reliability of it's operation.

Interpretation

[edit]

Opinion of the Court

[edit]Justice William Strong authored the majority opinion of the Court.[2]

[In progress]

Commerce Clause

[edit]The Supreme Court ruled in favor of Reading Railroad Company, the party challenging the state tax, ultimately declaring the Pennsylvania tax was unconstitutional. The court found that the tax on freight does indeed impose a burden on interstate commerce, which is protected by the U.S Constitution under the Commerce Clause.[2]

Pennsylvania was interfering with the free movement of goods across states by taxing the freight throughout the state, which could lead to substantial restrictions on commerce. The ruling emphasized that permitting Pennsylvania to impose such a tax could lead to an excessive amount of regulations that could hinder trade, undermining the U.S Constitution’s intent to create a unified economic system. Thus, to protect the integrity of interstate commerce, the court ruled the tax unconstitutional.[2]

The court also expressed concern that if states could impose such taxes, the market competition and dynamics could be disrupted due to discriminatory practices compared to out-of-state businesses.[2]

The fact that the state did not own its roads, was also considered by the Supreme court. It was pointed out that the tax was not compensation for the use of infrastructure owned by the state, as Pennsylvania did not actually own the railroads or canals. The court distinguished between a tax and toll, as one of them is a sovereign demand and the other are fees for services or infrastructure. The Supreme Court found that the state was overstepping its authority, as the tax was imposed on freight rather than the transportation service itself.[2]

See Also

[edit]References

[edit]- ^ "List of United States Supreme Court cases, volume 82", Wikipedia, 2024-07-25, retrieved 2024-09-22

- ^ a b c d e f g Reading Railroad Company v. Pennsylvania, vol. 82, 1872, p. 232, retrieved 2024-09-22

- ^ a b c d "CASE OF THE STATE FREIGHT TAX. READING RAILROAD COMPANY v. PENNSYLVANIA". LII / Legal Information Institute. Retrieved 2024-09-22.

- ^ a b "1864 Act 903". The official website for the Pennsylvania General Assembly. Retrieved 2024-09-22.

- ^ "Industry and Economy during the Civil War (U.S. National Park Service)". www.nps.gov. Retrieved 2024-09-26.

- ^ a b "Civil War ‑ Causes, Dates & Battles". HISTORY. 2023-04-20. Retrieved 2024-09-25.